How Do Trailing Stop Orders Work?

You can use a trailing stop order to place an order that will be executed after your original order fills. If the stock price falls below the trailing stop amount, it will trigger a market order instead. To set the amount of the trailing stop, use a percentage as opposed to an absolute amount. If the stock price drops below the trailing stop amount by 10%, it will trigger a sell order. This method is not recommended.

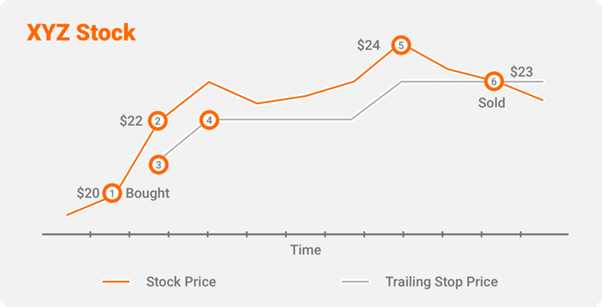

A trailing stop order works in much the same way as a basic stop order. However, it will only close a position if the price has retraced to that point. Otherwise, the position will be closed and any profits would be lost. Trailing stop orders allow you to lock in profits and minimize losses. When used correctly, trailing stop orders can be a highly effective tool. Here’s how trailing stop orders work:

You can configure a trailing stop order to use either the Last Price or Mark Price. If you set a trailing stop order using the Mark Price, the price will be higher when the mark price reaches your target. If you set the stop order at a lower price, you may be forced to exit a position too early. To make a trailing stop order work, make sure you check the price of the security first. If the price moves above your stop, you can still make a profit.

If you’re a conservative trader, a trailing stop order limits your losses to 5% of the total investment. When you’re more aggressive, you’ll need to decide what level of profit is acceptable for you. A trailing stop order is an excellent tool for aggressive traders, and if the price isn’t going up, it can protect your profits. This is why it’s important to have a risk management plan.

You can adjust the trailing stop order percentage to achieve the goal. You’ll need to adjust it to your experience and financial status periodically. You should also consider the callback rate and the activation price. With a low callback rate, your trailing stop could be triggered by a minor price change, causing you to lose money. If the trailing stop is set too low, the stock may continue moving downward, triggering your order.

A good trailing stop order includes both the Stop Price and the Trailing amount. The Trailing Stop order is also an important tool to use when trading volatile or low-volume stocks. As with any type of trading strategy, there is a time when it is better to leave a trade unfilled if it’s not doing what you’d hoped for. Then, you can work with the price range into your risk settings.

To put it simply, a trailing stop order is a stop order that remains in place if a stock price falls by more than $100. If the market price goes below the $100 threshold, the order will remain dormant. If the price drops below the level of the trigger, the order will be executed. Its implication is that, even if a stock price drops to zero, a trailing stop order will still remain in place.